Why digital payments are the more secure alternative

By Murray Gardiner, MD, Bluecode Africa

As retailers gear up for the busy holiday shopping season, they’re facing a multitude of risks. On the one hand, there’s the resurgence of COVID-19 in South Africa and Nigeria while Europe has reinstated lockdown restrictions. With the acceleration of e-commerce during this period, in-person shopping with cards is consequently an unattractive option (even more so than it already was). On the other hand, with increased demand for online payments, comes the rising tide of cybercrime and card fraud.

The solution, on both sides of the spectrum, is for businesses to embrace digital payments (off the card rails) that can be secured with anonymity and do not require encrypted customer information and card authentication processes. Merchant-centric payments that provide digital transparency without compromising privacy, while driving sales and empowering businesses of all sizes are needed. It has never been more important to push financial inclusion for businesses and drive market momentum.

The trouble with cash

At present, cash is still king in Africa. According to one report, cash accounts for over 50% of transaction value in South Africa. This is despite South Africa having one of the most mature banking and payment spaces and the deepest card penetration rates on the continent. Another study, by Ghana’s Ministry of Finance, indicated that 99% of all payments in that country are made in cash.

Despite the growth of digital payments, cash isn’t going away. In fact, a report from The Currency Association shows that the value of cash in circulation grew steadily in six major African countries between 2008 and 2017.

That’s understandable. Cash is easy to understand. Cash is trusted. You hand over a set amount and get the goods or services you desire. It’s also so culturally entrenched that it doesn’t require learning new behaviours or merchants learning to “trust” that somehow their valuable goods are being exchanged for money in an account somewhere.

Despite its ubiquity and standing as the most deeply entrenched incumbent payment mechanism, there are serious downsides to cash. Aside from the cost implications and security considerations, cash doesn’t provide transparency to the bank for access to better financial services nor does it facilitate access to relevant value-added services which can provide business-growth incentives.

Cash is opaque by nature, which makes it difficult for a bank to understand a business. That opacity effectively ‘locks out’ small businesses from most of the benefits of the formal economy. Although many businesses are considered to be “included” for having a transaction account, cash-based businesses present too much cost and risk to be banked with higher value financial services and credit.

Digital transparency is essential to reduce transaction costs for the business and for the banker to understand how to invest and support their merchant client-base with financial products and services.

Securing e-commerce

Physical merchants aren’t the only ones facing threats this festive season. While 2020 may have accelerated e-commerce sales, especially in emerging markets, it also made it ‘target-rich’ for cybercriminals. Imperva’s State of Security Within e-Commerce report found that e-commerce websites experienced much higher levels of cyber-attacks than other businesses. Retailers and app providers have also become vulnerable to losing sales to cumbersome card security processes and consumers have become vulnerable to phishing scams and other fraudulent activity.

Most cyber-attacks are conducted with the aim of getting hold of sensitive customer data. And while the website itself might not hold that data, there’s every chance that its payment provider does. In the event of a breach, however, that will likely make little difference as far as the customer is concerned.

Any online business associated with a data breach will suffer major reputational damage, which can be incredibly difficult to come back from. Breaches are also expensive, with the average breach costing in excess of 40 million in SA Rand value.

But while it’s impossible to completely avoid cybercrime, there are steps that online retailers can take. The right digital payment provider will, for example, give businesses a secure anonymous token-based, hassle-free click and pay solution, where no customer data is associated with the payment. Where there is no data there is nothing to steal.

Secure, transparent, inclusive

Given that digital payments can provide such levels of security both to traditionally cash-based smaller businesses and to online retailers, it would make sense for them to adopt the technology en-masse. After all, with so much at stake this year, the imperative for merchants to reduce risk on all fronts has never been higher.

But it shouldn’t just be merchants trying to understand, and find, the right digital payment provider. Financial institutions should also encourage and incentivise merchants to adopt these technologies and find for themselves an off-ramp from legacy card-based payment schemes.

Doing so won’t just make consumers and businesses more secure at a time when they both need it most, it will also empower businesses to be more efficient and profitable in the long run. That’s the most important form of security there is.

About Bluecode:

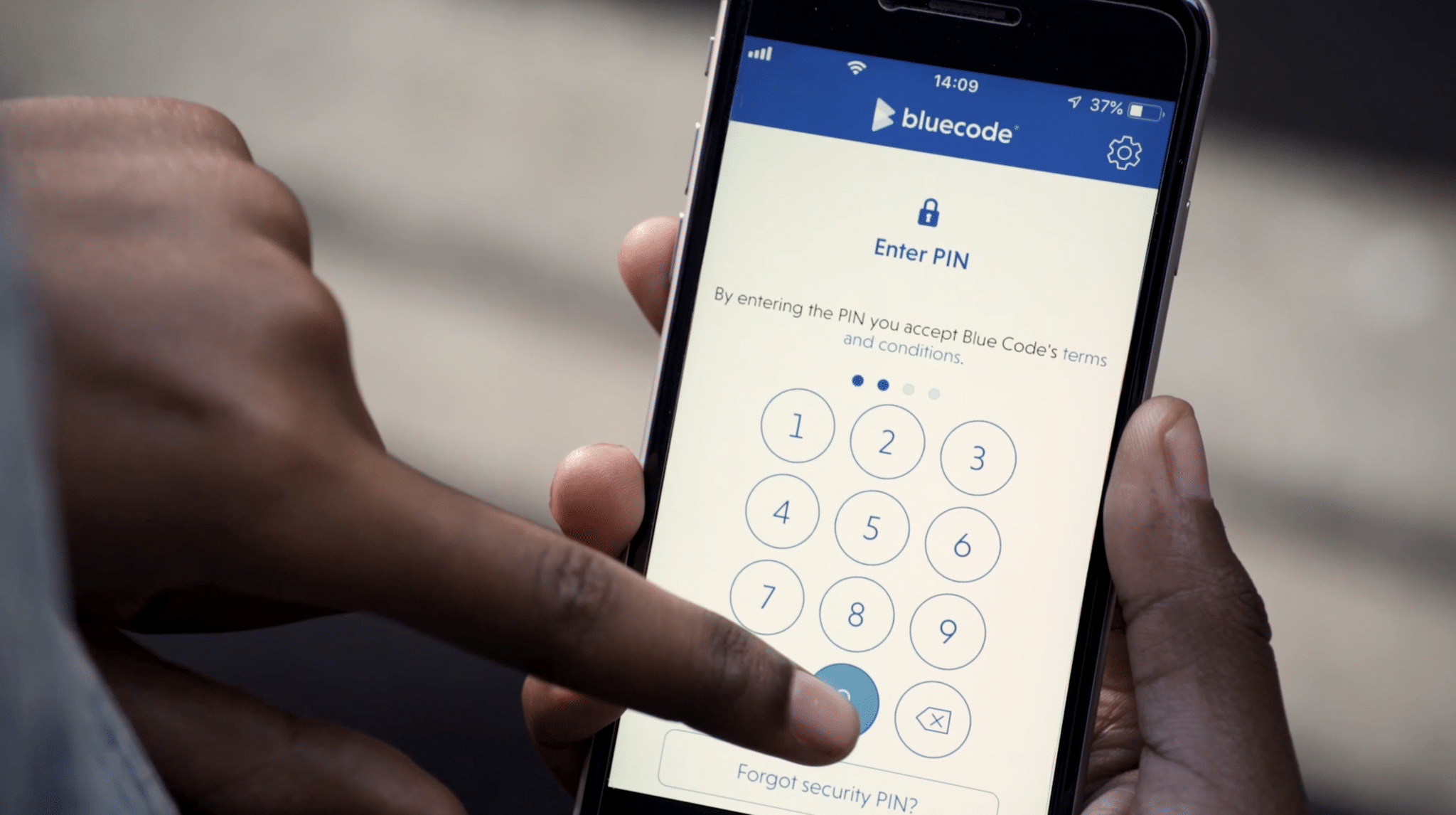

Bluecode is a mobile payment solution that combines cashless payments via smartphones with value-added services and enables payments with merchant and banking apps. Founded in Europe, Bluecode has now expanded into Africa. Bluecode Africa is taking mobile payments into markets where its value as a technology payment service and scheme can make a significant difference for retailers, SMMEs and in the everyday lives of consumers. Bluecode Africa is focused on driving economic growth in the productive economy by unlocking opportunity and business potential with digital transparency. For more information: www.bluecodeafrica.com