As economies reopen in various parts of the world, the price of some commodities has soared, including the prices of prominent industrial metals. The extent to which the metals price rally may lose steam depends on how multiple factors will play out.

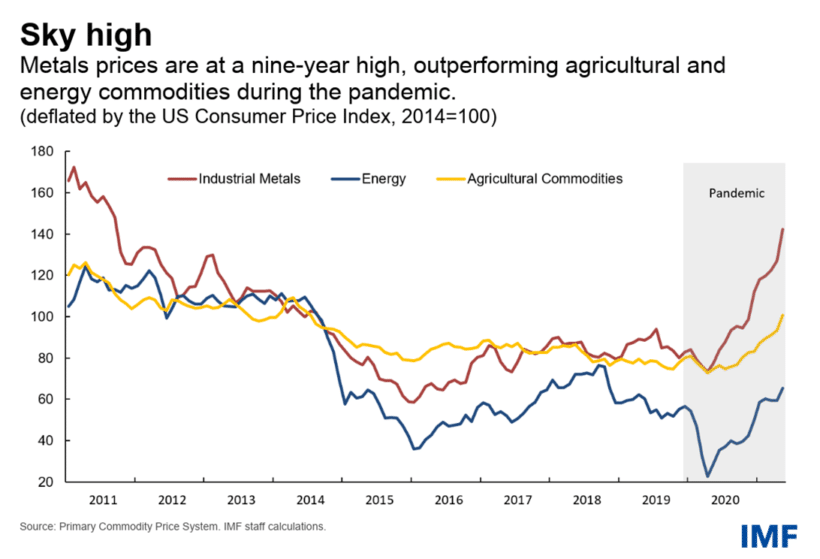

As our latest chart of the week shows, metals prices have increased by 72 percent relative to their pre-pandemic levels—reaching a nine-year high in May (in inflation adjusted terms). The increase has been broad-based across industrial metals—copper is up 89 percent in May (year-over-year), iron ore is up 116 percent, and nickel is up 41 percent. The prices of most agricultural and energy commodities are also tracking upward, but at a slower rate. Energy commodities (oil, coal, and natural gas), in particular, sit only a few percentage points above pre-pandemic levels.

Why have metals prices increased much more than other commodities? There are four reasons:

- A manufacturing-based recovery: Manufacturing activity did not slump as much at the start of the pandemic and recovered more quickly than services, especially in China, which is the major user of metals. At the same time, sectors in which energy commodities feature prominently, like the transportation sector, remain depressed. For example, global road fuels consumption is still at 93 percent of pre-pandemic levels, restraining a further rebound of petroleum prices.

- Supply-side factors: Many mining operations were temporarily disrupted by COVID-19. What’s more, freight rates for the transportation of bulk materials reached a ten-year high due to congestion in key ports, quarantine restrictions, ongoing problems staffing shipping crews, and a rebound in fuel prices from the deep troughs in Spring 2020. This all added to the cost of metals.

- Expectations for faster energy transition and infrastructure spending: Buoyant expectations about the pace of the transition to a greener economy and ambitious infrastructure programs gave metals prices an additional boost. Both would increase the “metal intensity” of the global economy. A fast energy transition, for example, could require a 40-fold increase in the consumption of lithium for electric cars and renewables, while the consumption of graphite, cobalt, and nickel for these purposes may rise around 20 to 25 times, according to the International Energy Agency. Ambitious infrastructure programs in the European Union and the United States would drive up the demand for copper, iron ore, and other industrial metals.

- Storability of metals: Metals are easier to store than crude oil or some agricultural goods, which need special facilities. This makes their pricing more forward looking and, thus, more sensitive to changes in interest rates (lower interest rates reduce the “cost of carry,” which also includes cost of storage, insurance, and other expenses, and, thus, tend to support commodity prices) and market expectations, such as the ones about a faster energy transition and infrastructure spending.

Will metals’ prices keep increasing or retrench? This is a challenging question.

Market participants seem to expect a peak in metals prices relatively soon, as factors (1) and (2) are supposedly temporary in nature. Indeed, futures markets suggest an increase of industrial metal prices by 50 percent in 2021 (year-over-year), but a decrease by 4 percent in 2022.

Still, prices are expected to remain high and could rise further, especially if demand from an energy transition accelerates. On the flip side, prices may decrease more than expected if legislative approval and government actions required for the energy transition and infrastructure programs do not materialize as expected.

Martin Stuermer is an economist in the Commodities Unit of the IMF’s Research Department.

Nico Valckx is a senior economist in the Commodities Unit of the IMF’s Research Department.