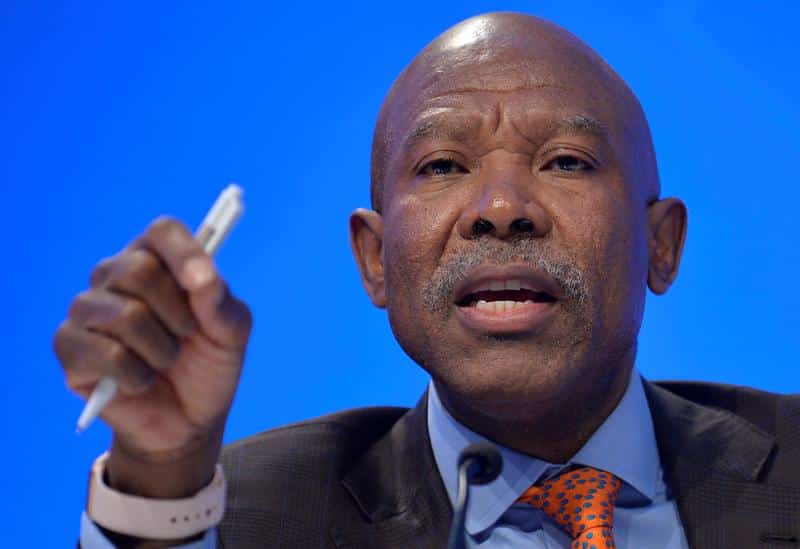

JOHANNESBURG, Nov 24 (Reuters) – Below are some quotes from South African Reserve Bank Governor Lesetja Kganyago as he announced the central bank’s latest interest rate decision on Thursday.

INFLATION

Globally, economic growth is slowing and prices have fallen for some goods and transport services. However, price pressures continue to spread from goods to services and wages.

Inflation expectations increased strongly over this year and remain high. Expectations of future inflation surveyed in the third quarter of this year had earlier increased to 6.5% for 2022 and 5.9% for 2023.

For 2024, the BER survey of inflation expectations in Q3 moderated to 5.3% (from 5.4%). The Q3 survey had 2022 expected inflation at 6.5% and 5.9% for 2023. Surveys have increased to 6.8%.

By contrast, long-term inflation expectations derived from the 5-year break-even rates in the bond market have moderated to 5.27%.

In the second quarter of this year, headline inflation breached the upper end of the target range, and is forecast to remain above it until the second quarter of 2023.

Headline inflation is only expected to sustainably revert to the mid-point of the target range by around the second quarter of 2024. The forecast takes into account the policy rate trajectory indicated by the Bank’s Quarterly Projection Model (QPM).

As usual, the repo rate projection from the QPM remains a broad policy guide, changing from meeting to meeting in response to new data and risks.

GROWTH

As a result of these factors, the economy is forecast to expand by 1.1% in 2023 (from 1.4%) and by 1.4% in 2024 (from 1.7%), below previous projections.

GDP growth of 1.5% is forecast for 2025.

With a low rate of potential, our current growth forecast leaves the output gap slightly larger in the near term, before closing in the third quarter of 2023.

Global growth in the QPM model is a trade-weighted average of South Africa’s trading partners. Global growth in 2024 is forecast unchanged at 2.4%, before rising to 3.1% in 2025.

The growth forecast includes expected changes in the policy rate as given by the QPM.

Potential growth for 2022 is revised lower at 0.4%, 0.5% in 2023 and unchanged at 1.1% in 2024. For 2025, potential growth is forecast at 1.5%.

After revisions, the risks to the medium-term domestic growth outlook are assessed to the downside.

Commodity price movements in recent months have been mixed, with oil prices relatively stable and export prices lower.

Compared to September, our oil price forecast is broadly unchanged, averaging US$102 per barrel for 2022 and US$92 per barrel in 2023.

South Africa’s export commodity price basket has come down from earlier peaks.

As a result of weaker export developments, the current account balance is expected to be -0.2% of GDP this year, falling to -1.5% in 2023 and -1.9% in 2024.

The current account balance in 2025 is expected to be -2.1% of GDP.

(Compiled by Nellie Peyton; Editing by James Macharia Chege)