Brazilian stocks fell more than 10 percent in opening trade Thursday on an emerging scandal involving the country’s recently installed president.

Trading of some shares was delayed, Dow Jones reported.

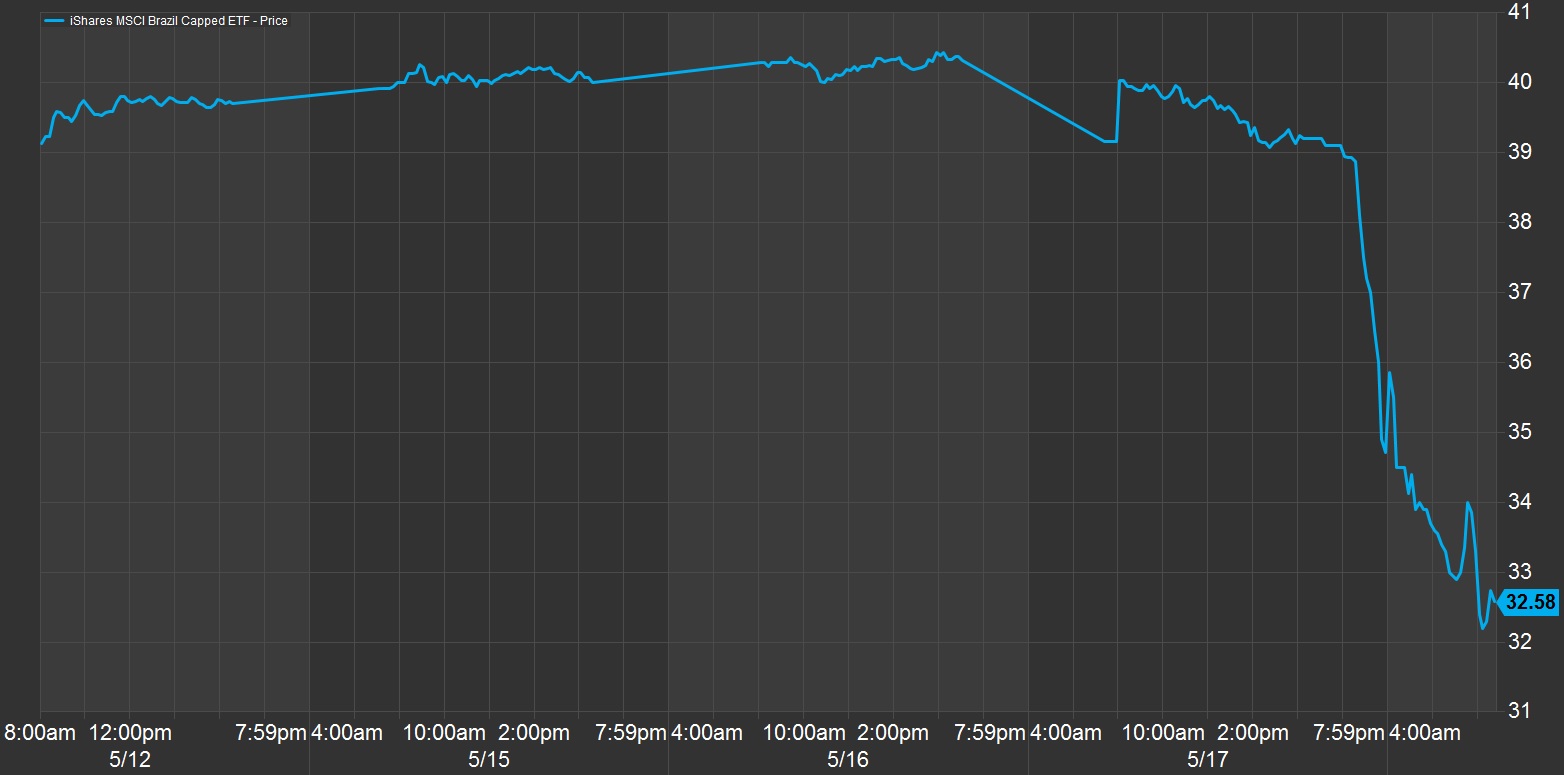

The iShares MSCI Brazil Capped ETF (EWZ), a heavily-traded U.S. ETF that tracks Brazilian stocks, briefly dropped more than 17 percent in opening U.S. trade.

Temer told lawmakers Thursday that his government would not be toppled by allegations he was caught on tape trying to buy the silence of a potential witness in a sprawling graft investigation, a senator who was at the meeting told Reuters.

EWZ 5-day performance (extended hours)

Source: FactSet

Temer’s office on Wednesday acknowledged he had met in March with the businessman, Chairman Joesley Batista of meat giant JBS SA, but denied any part in alleged efforts to keep jailed former House Speaker Eduardo Cunha from testifying.

O Globo’s report, which they say three sources familiar with the matter said was accurate, threatened to pull Temer into a corruption scandal that has already entangled several of his closest allies and advisors.

“We believe the administration’s economic team is highly concerned the crisis will impact their reform agenda,” Larry McDonald wrote Thursday in “The Bear Traps Report” newsletter. “Equity prices / valuations are very dependent on completion / passage of these reforms.”

U.S.-listed shares of major Brazilian stocks plunged in morning trade:

- State-run Petrobras dropped more than 14.5 percent.

- Banco Bradesco fell more than 18 percent.

- Vale SA down nearly 8 percent.

- Itau Unibanco fell 14.5 percent.

The iShares MSCI Emerging Markets ETF (EEM) fell more than 2 percent.

Brazil makes up 7.43 percent of the MSCI Emerging Markets Index, as of April 28. China is the country with the greatest weighting, at 27.05 percent.

The Brazilian real fell more than 6 percent against the U.S. dollar Thursday morning.

The opening drop in the Brazilian stock market triggered a circuit breaker on the Bovespa exchange, Bloomberg reported.

Brazilian equities have surged over the past year, with the EWZ rising more than 45 percent in the period, as investors cheered Temer’s proposed economic policies. The fund is one of the 20 most actively-traded ETFs in the U.S. market on a daily basis, on average.

“Brazil blows up every couple years,” Tim Seymour managing partner of Triogem Asset Management, said in an email. It “got overcrowded for regional dedicated players.”

The country’s stocks are about “8 percent of the EM index and taking EM down today more than it might,” Seymour said. “That creates an opportunity but think about the politics across EM right now.”

The new president and his promised reforms were supposed to turn the page on Brazil’s rocky political climate. Temer became leader of the country after President Dilma Rousseff was removed Aug. 31 amid a massive corruption scandal and an economic crisis that crippled Latin America’s largest country.

“Now the fear is that Temer might have to leave office like his predecessor, Dilma Rousseff,” said Komal Sri-Kumar, president of Sri-Kumar Global Strategies. “But it’s too early to panic because there are a lot of steps to removing a president in Brazil.”

Brazil had been an economic stalwart in the region just a few years before Rousseff’s impeachment, buoyed by surging oil prices. But the collapse in the crude market, coupled with a corruption scandal at Petrobras, led to millions of Brazilians flooding the streets in protest of Rousseff’s presidency.

—Reporting by Fred Imbert | Evelyn Cheng and Reuters