MIAMI – Crypto lingo and booze flowed freely as thousands of bitcoin enthusiasts descended on South Florida this weekend.

At Bitcoin 2021, billed as the biggest bitcoin event in history, legions of faithful fans braved 90-degree days to talk all things crypto. Many of the conference attendees were bitcoin maximalists, a phrase used to describe people who believe that bitcoin, and not necessarily other cryptocurrencies, is the future of finance. Most plan to BTD (buy the dip) and HODL (hold on for dear life).

The energy was electric. A maskless, sold-out crowd of 12,000 attendees spent two days glad-handing, hugging, sending crypto from wallet to wallet, and closing business deals in between panels and speeches. The novelty of taking part in a largely indoor event, free of Covid restrictions, contributed to the atmosphere.

A standard pass to the event cost $1,499. Some guests paid for a highly coveted orange bracelet, known as the “Whale Pass,” which takes its name from a term used to describe individuals who hold large sums of bitcoin. The pass granted access to an extra day of speakers, exclusive parties, and a private area in the convention hall, replete with a free bar. On the first day of the conference, it was retailing on Eventbrite for $21,000, plus a $529 transaction fee.

The crowd look was mixed. Picture conference merch like neon-colored fanny packs, Bitcoin 2021 branded sunglasses, and t-shirts with crypto puns and hashtags. Some appeared ready for a summer rave, wearing bikinis in the media room.

However, there was also a strong contingent clad in standard Wall Street business casual, in yet another sign of growing mainstream interest in the world’s most popular cryptocurrency. “Whether they were attendees, or just in Miami for the events, it is more institutional participation than I’ve ever seen at a bitcoin conference,” Nic Carter, founding partner at Castle Island Ventures, told CNBC.

Miami lights up for crypto

For the thousands who didn’t get an official ticket to the event, the parties and tangential gatherings were the real draw. There were yacht parties with a DeFi (decentralized finance) theme, sumo wrestling matches, NFT art gallery openings, and cocktail hours dedicated to talking about Bitclout, a social network built on the blockchain technology that underpins most cryptocurrencies.

The after-parties took over rooftops across the city, with at least one featuring fire dancers. The Oasis, one of the biggest nightclubs in Miami, was non-stop crypto.

“There isn’t a way to quantify the level that an event like this boosts business,” said Mati Greenspan, portfolio manager and founder of Quantum Economics, who flew in from Israel Wednesday night for the event. “What might take me an hour meeting at home can be done in five or ten minutes at a conference. So every hour is worth five or ten meetings.”

Mati Greenspan

A lot of talk centered around moving to Miami. Start-ups, venture firms, and crypto exchanges have been relocating to the city en masse – or at least opening additional offices.

Mayor Francis Suarez has portrayed himself as bitcoin-friendly – Suarez announced in February that Miami plans to accept tax payments in bitcoin and let employees draw their salary in the cryptocurrency, though the timing of the rollout is unclear. The city is also exploring holding bitcoin on its balance sheet.

Now, the entire city seems to be getting on board. “From waiters to Uber drivers, a bouncer at the nightclub and even a lady selling tchotchkes at the mall, most locals I met on the ground seemed to be somewhat familiar with cryptocurrencies, and many of them are HODLing,” said Greenspan, of the few days he spent in Miami.

Carter himself is considering the move. “Virtually everyone I’ve talked to is super bullish on Texas and Florida and pretty bearish on on New York, San Francisco, and Boston,” he said. “I left this thinking that I’m going to make that transition myself.”

‘Bitcoin fixes everything’

A common refrain from some of the biggest names on stage was that “bitcoin fixes everything,” which pretty much sums up the general sentiment at the conference.

“We say bitcoin is hope; bitcoin fixes everything,” said Saylor. “That certainly was the case with our stock.”

Dorsey also doubled down on his commitment to the cryptocurrency. “If I were not at Square or Twitter, I’d be working on bitcoin. If it needed more help than Square and Twitter, I would leave them for bitcoin,” said Dorsey.

The undertone of widespread support for bitcoin carried with it a spirit of rebellion against the existing financial system.

“We don’t need the banks anymore,” continued Dorsey. “We don’t need the financial institutions that we have today.”

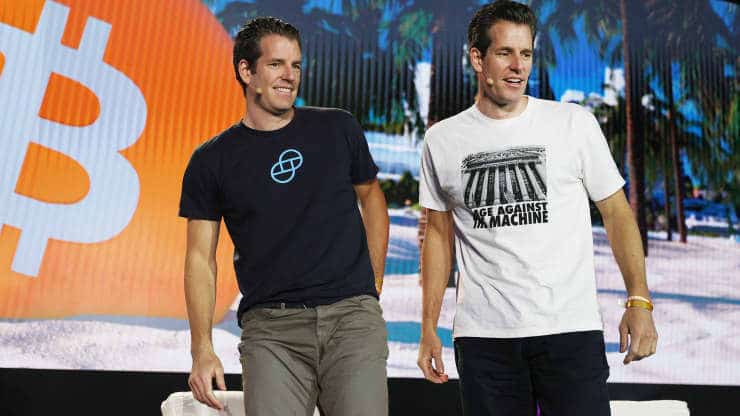

Cameron Winklevoss wore a T-shirt with a picture of the Federal Reserve building with a caption reading, “Rage against the machine,” a reference to how bitcoin is not controlled by a central bank.

As one panel MC put it, “We are going to put the Fed out of business,” which speaks to how people at Bitcoin 2021 generally regarded the monetary system and fiat money, with bitcoin seen as the solution.

Joe Raedle | Getty Images

But a repudiation of the status quo doesn’t mean anarchy. In many of my conversations with attendees, the narrative was far from an advocation of societal collapse or dissolution.

“The whole point of bitcoin is that it’s a…peaceful protest against a monetary system that people want no part of,” said Carter. “I don’t think the Fed has a lot to fear from bitcoin. You don’t have to take to the streets to promote bitcoin.”

The conference drew participants from countries with high inflation or other currency troubles – places like Venezuela, Cuba, Turkey, Nigeria, Lebanon, and Iran – who perhaps best understand the use case for a cryptocurrency like bitcoin.

“There are hundreds of people in these places and you don’t have to explain bitcoin to them; they understand it intuitively,” explained Carter. “That was one of the best parts of the conference for me: meeting people who felt the real-world impact of currency collapse and seeing how they use bitcoin.”

One consistent theme of the conference was the maturity of the Lightning Network, a payments platform built on bitcoin, which enables instant transactions.

Virtually every booth at the conference was accepting Lightning transactions. Even Square and Twitter CEO Jack Dorsey completed one during his main stage talk with Alex Gladstein, of the Human Rights Foundation.

“That’s a real success story,” said Carter. “It’s taken four or five years for Lightning to be built on top of bitcoin, but it’s working now.”

The shadow of Elon

Elon Musk wasn’t physically in Miami but his presence was definitely felt. Right at the start of the conference, the price of bitcoin dropped following a tweet by the Tesla CEO that implied he was breaking up with the currency.

Max Keiser, a high-profile bitcoin holder, began his fireside chat by cursing Musk’s name, shouting, “F— Elon!” several times.

On the main stage, Dorsey took what seemed to be a veiled shot at Musk’s critique of the environmental impact of bitcoin mining, saying that it actually “incentivizes more renewable energy.”

“You just look at the economics of it and ultimately miners have to make a profit and getting cheap renewable energy maximizes their potential for profit. It’s really that simple,” continued Dorsey. “I thought I had an agreement with some notable figures out there, and that seemed to change in a matter of weeks and now it’s in a weird kind of place.”

Michael Saylor, a high-profile crypto advocate and the CEO of MicroStrategy – a company that bought bitcoin for its balance sheet last year, before both Square and Tesla – took Dorsey’s comments one step further.

“It’s the highest value use of intermittent energy. It’s the highest value use of renewable energy. It’s the highest value use of wasted or stranded energy. And it’s just the highest value use of energy, period,” said Saylor.

NFL player and bitcoin fan Russell Okung launched a billboard campaign Friday with the tagline “Stick to space, Elon,” a reference to the fact that Musk should stay in his lane, and leave crypto opining to those in the industry.

Most conference attendees said they were ignoring his comments regardless. Many said they don’t think Musk, or anyone else – not even governments – can stop bitcoin. One person in the bathroom line called him a clown, referring to his promotion of a new, pornographically named cryptocurrency over the weekend.