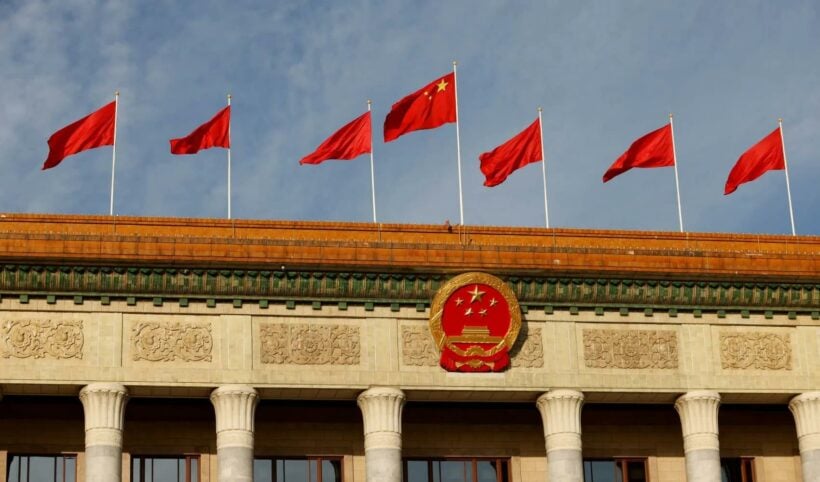

Edgar Su | Reuters

BEIJING — China is set this week to kick off its annual parliamentary meetings, which investors are watching closely for signals on economic stimulus.

The country’s gross domestic product grew by 5.2% in 2023, but overall recovery from the Covid-19 pandemic was slower than many had expected. A prolonged slump in the massive real estate market and falling global demand for Chinese exports have contributed to low levels of consumer and business sentiment.

That’s all led to questions over whether Beijing will step in with large-scale support. So far, authorities have been relatively reserved.

Beijing signaled in December that any new policy support would be “appropriate,” said Wang Jun, chief economist at Huatai Asset Management, adding “there’s no way” that stimulus would be as large as it was in 2008. That’s according to a CNBC translation of his Mandarin-language remarks.

China’s economic policy is typically set at an annual meeting in December by leaders within the ruling Communist Party of China.

The meetings this month, known as the “Two Sessions,” are at the government, instead of party, level and typically release more details on policy plans, such as the GDP target for the year.

Wang said he is watching for comments on authorities’ plans for the real estate sector, capital markets and local government finances.

Back in 2008, when the world was reeling from the financial crisis, China unleashed a massive stimulus package to sustain growth with greater demand. While the economy rebounded, the measures drew criticism for a resulting surge in local government debt.

Beijing in recent years has emphasized the need to stem financial risks and clamped down on real estate developers’ high reliance on debt for growth, an issue tied to local government finances. This time around, China’s monetary policy also faces constraints on how far it can deviate from the U.S. Federal Reserve’s interest rate path.

GDP and other economic targets

The Chinese People’s Political Consultative Conference, an advisory body, is set to kick off its annual meeting on Monday.

The following day the National People’s Congress legislature is due to begin its meeting. Tuesday is also when the country’s premier is expected to share the year’s targets for GDP, employment and other economic indicators in what’s called the “Government Work Report.”

“The target will likely remain relatively high,” said Bank of China’s chief researcher Zong Liang, noting GDP grew by 5.2% last year. That’s according to a CNBC translation of his Mandarin-language remarks.

He expects the target for the fiscal deficit will be around 3.5% and that monetary policy will also be relatively loose.

China in October made a rare announcement that it was raising the fiscal deficit to 3.8%, from 3%.

“We expect the on-budget deficit – which excludes special bonds, policy bank bonds, and local government financing vehicle (LGFV) debt – to be set at 3.0%-3.5% of GDP, narrowing from last year’s 3.8% of GDP,” Louise Loo, lead economist at Oxford Economics, said in a report Thursday.

“We expect a modest step-up in the local government special bonds (LGSB) quota, to RMB4.0tn from RMB3.8tn last year,” Loo said. “Authorities may also finally put pen to paper on the reported RMB1tn in planned central government special bonds (CGSBs), reflecting the increasing role of central coffers amid a continued debt cleanup process among local government entities this year.”

“On balance, the additional fiscal impulse this year, assuming a bazooka-like fiscal package is not forthcoming, is unlikely to be particularly large.”

Watching for comments on real estate and tech

The Two Sessions is also a period for releasing the budget and for delegates to discuss needed policy changes and plans.

“Speeches by top policymakers will be key to watch, including interviews of key ministers, such as Minister of Industry and Information Technology, Minister of Science and Technology, and Minister of Housing and Urban-Rural Development. These key ministers will discuss various policies in more detail,” Goldman Sachs analysts said in a report.

During the parliamentary meetings, Chinese officials will likely also discuss plans to bolster tech and innovation, in line with a recent high-level call to bolster “new productive forces.”

Authorities announced Monday that China’s premier would not hold the usual press conference at this year’s parliamentary meeting, and that such press meetings are canceled for the rest of the current congressional term, which would typically run for another three years. The announcement noted there would be more ministry-level press conferences on the economy and foreign affairs, but did not say whether the foreign minister would hold a press conference as has been the case in past years.

The advisory body is set to conclude its annual meeting on Sunday, March 10, according to an official announcement. The National People’s Congress is set to end the afternoon of the following day, Monday, March 11.

Bank of China’s Zong expects that policymakers will send signals on opening up borders or other business opportunities to foreigners, as well as improving the environment for non-state-owned enterprises.

However, specific implementation details are typically left to individual ministries to announce, following high-level directives from Beijing.

Any direct support for consumption is unlikely, but broader moves to improve the social safety net would be of note.

“On the demand side, the delayed Third Plenum [of the Chinese Communist Party’s Central Committee] (originally set for December) suggests that longer term demand policies – including on fiscal, tax, and pensions reforms – may still be in initial stages of discussion, but could still warrant a mention here,” Loo said.

The macro context

This year’s Two Sessions follow regular leadership reshuffles that have strengthened the ruling Communist Party of China’s control of the government.

At the parliamentary meeting last year, Beijing announced an overhaul of finance and tech regulation by establishing party-led commissions to oversee the two sectors. Chinese President Xi Jinping, who is also the party’s general secretary, gained an unprecedented third term as president.

No major Chinese government or party leadership positions are scheduled to change this year, while the U.S. is set to hold its presidential election in November.

Since last summer, Chinese authorities have already announced a slew of policies to bolster growth and acknowledged the need to increase confidence. Critics say the measures are relatively piecemeal.

Recent economic data releases point to a mixed picture for growth, with some improvement in manufacturing but real estate at best only stabilizing.

Huatai’s Wang expects the economy will recover gradually this year, and that in contrast to last year, nominal GDP will be better than real GDP. That means the perceived improvement this year will be more tangible for consumers and businesses.